Accounting & Bookeeping System

RM10,350.00

Our accounting software offers intuitive banking features, seamless transaction mapping, and automated categorization for efficient financial management. With robust reporting tools and customizable settings, you can track expenses, monitor budgets, and gain valuable insights into your business’s financial health. Ideal for businesses of all sizes, our platform simplifies accounting tasks and enhances productivity.

*One-off Pricing (Installation on your hosting server by our team)

*Annual Maintenance Fee (For updates, any bugs caused by original code (excluding those customization & integration))

*Lead Time: Within 30 Business Day

*Price does not include hosting fees and physical training fees

*Customization and integration with the existing system are not included

30 in stock

Accounting involves the systematic process of documenting and monitoring financial transactions to evaluate the financial well-being of an entity. It encompasses tasks such as recording, categorizing, quantifying, and conveying transactions through various formats. Accounting comprises both bookkeeping, which entails recording transactions, and analysis, which involves interpreting these transactions to generate informative reports reflecting the financial status. These reports, such as profit and loss statements and cash flow analyses, offer insights into financial performance and aid in managing obligations like sales tax. By diligently managing accounting tasks, small business owners gain a clear understanding of their financial standing, enabling them to make informed decisions based on available resources.

Features List:

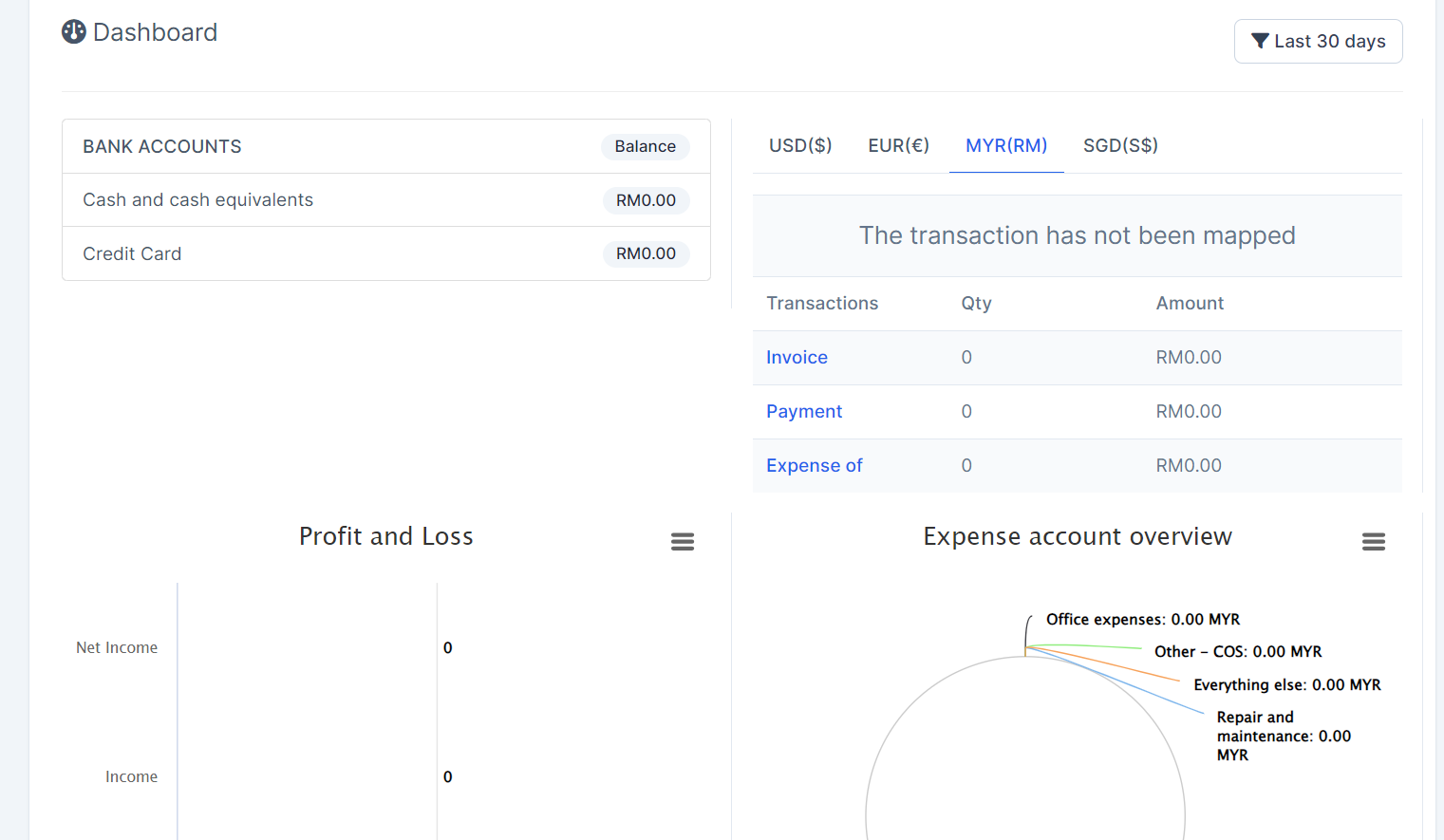

- Dashboard:

- Profit & Loss Chart

- Income Chart

- Expense Chart

- Cashflow Chart

- Bank Accounts Overview

- Banking:

- Banking Register

- Posted Bank Transaction

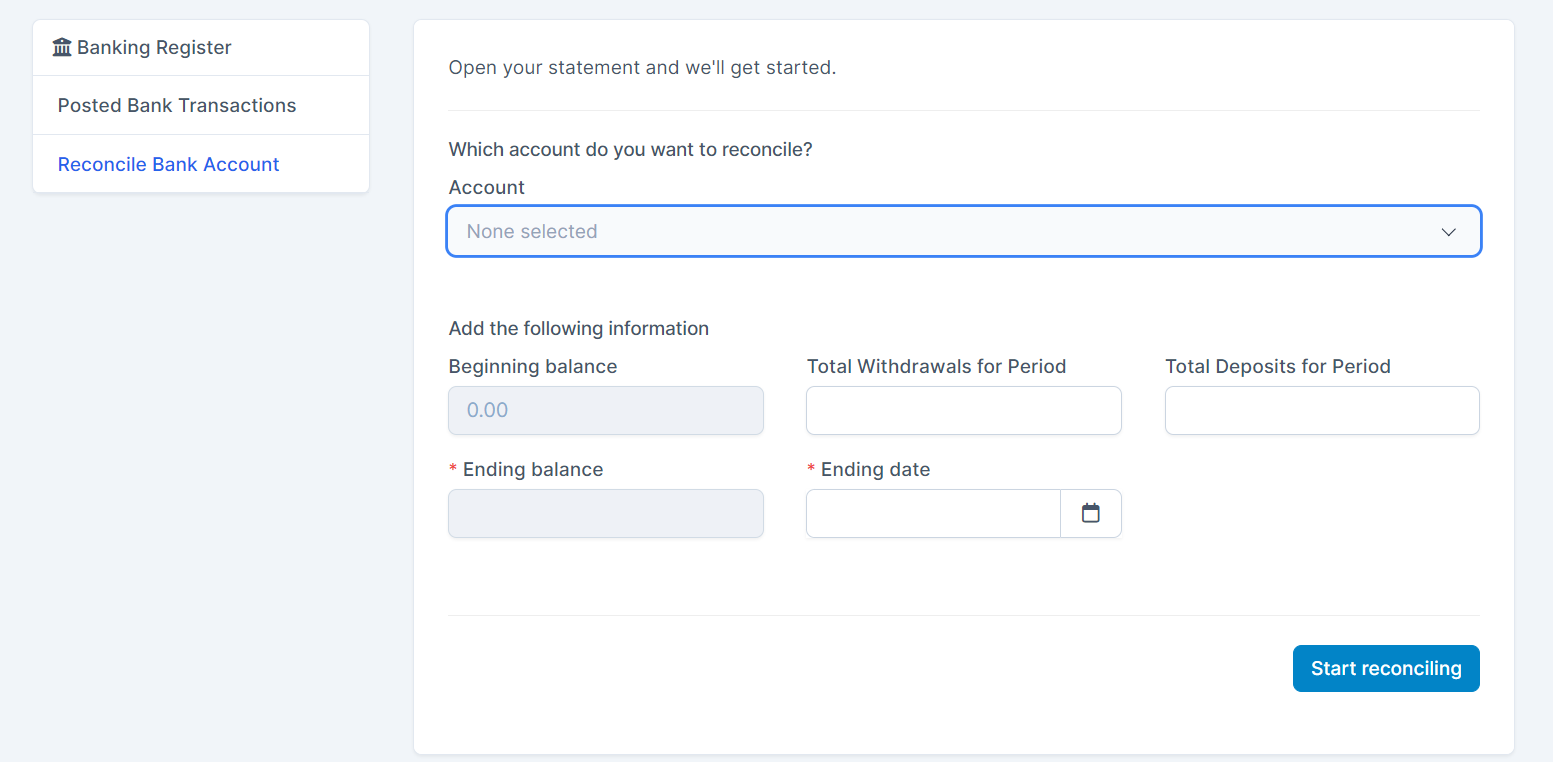

- Reconcile Bank Account

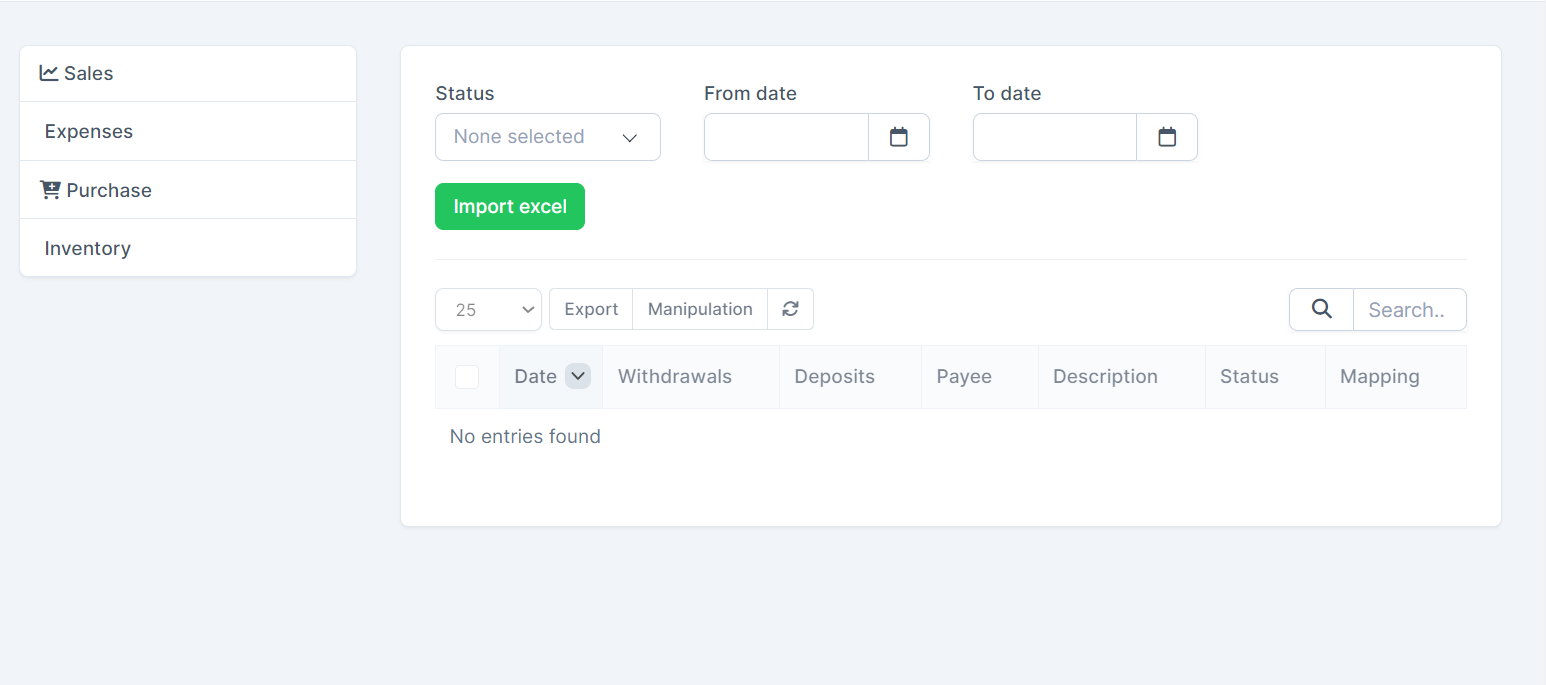

- Import Bank Transactions

- Transactions:

- Mapping Bank Statements to Accounting

- Mapping Invoices to Accounting

- Mapping Payments to Accounting

- Mapping Expenses to Accounting

- Optional: Mapping Purchase to Accounting (requires additional module)

- Optional: Mapping Inventory to Accounting (requires additional module)

- Optional: Mapping Payroll to Accounting (requires additional module)

- Mapping Setup:

- Item Mapping

- Expense Category Mapping

- Tax Mapping

- Purchasing Mapping

- Inventory Mapping

- Banking Rules: Automatically categorize transactions for efficient record-keeping.

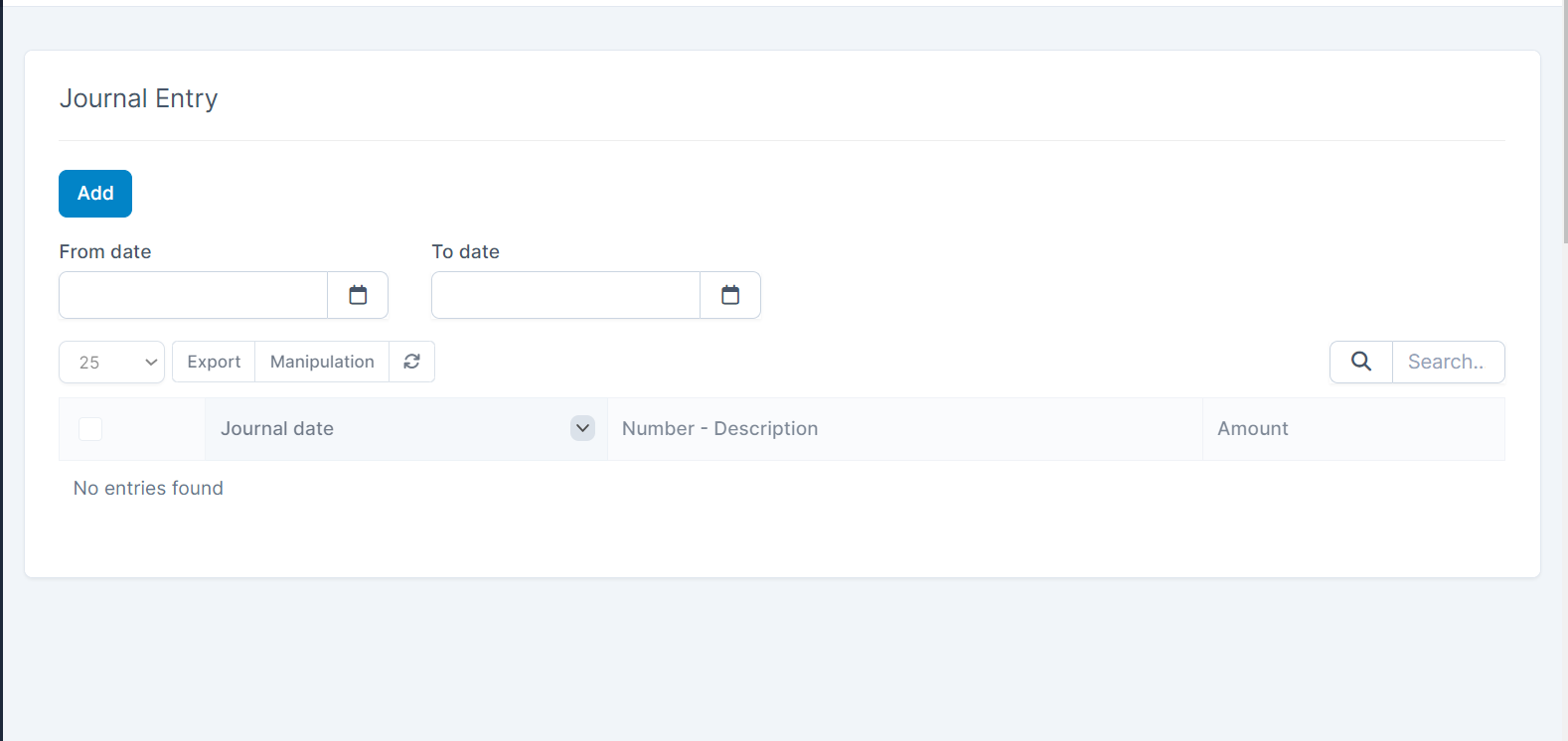

- Journal Entry: Record transactions in the general ledger.

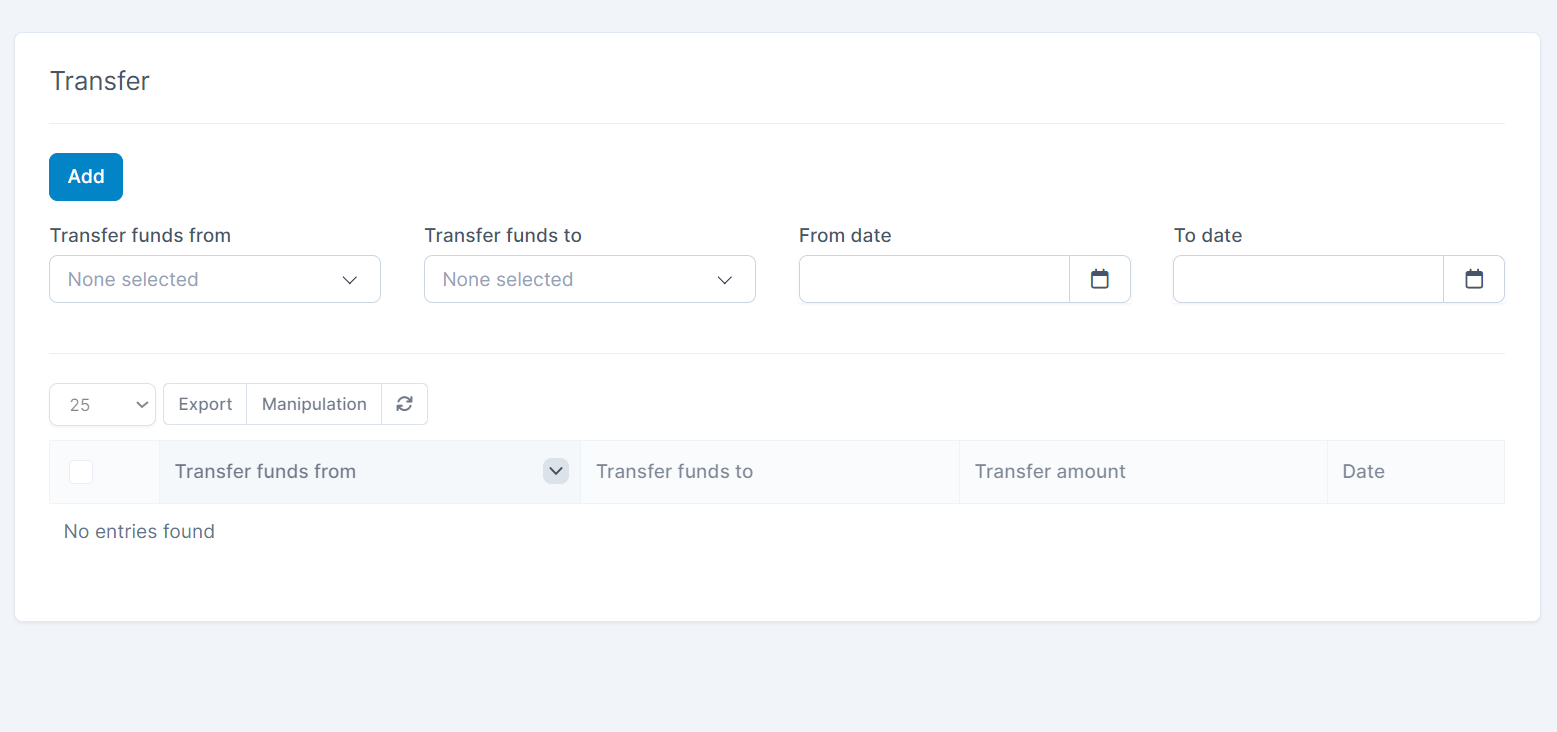

- Transfer: Transfer amounts between accounts.

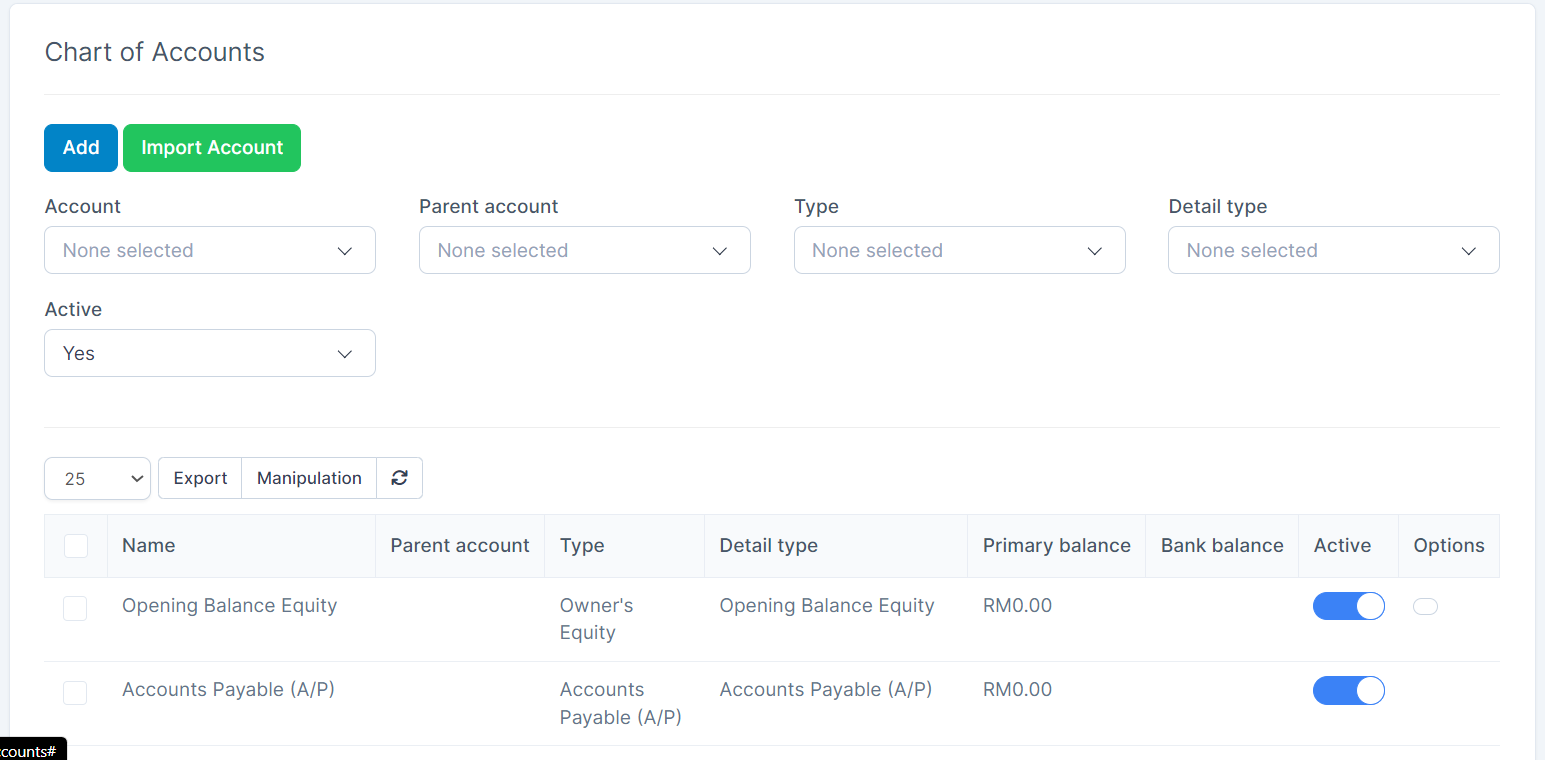

- Chart of Accounts: List of account numbers and names categorized into Asset, Liability, Income, and Expense accounts.

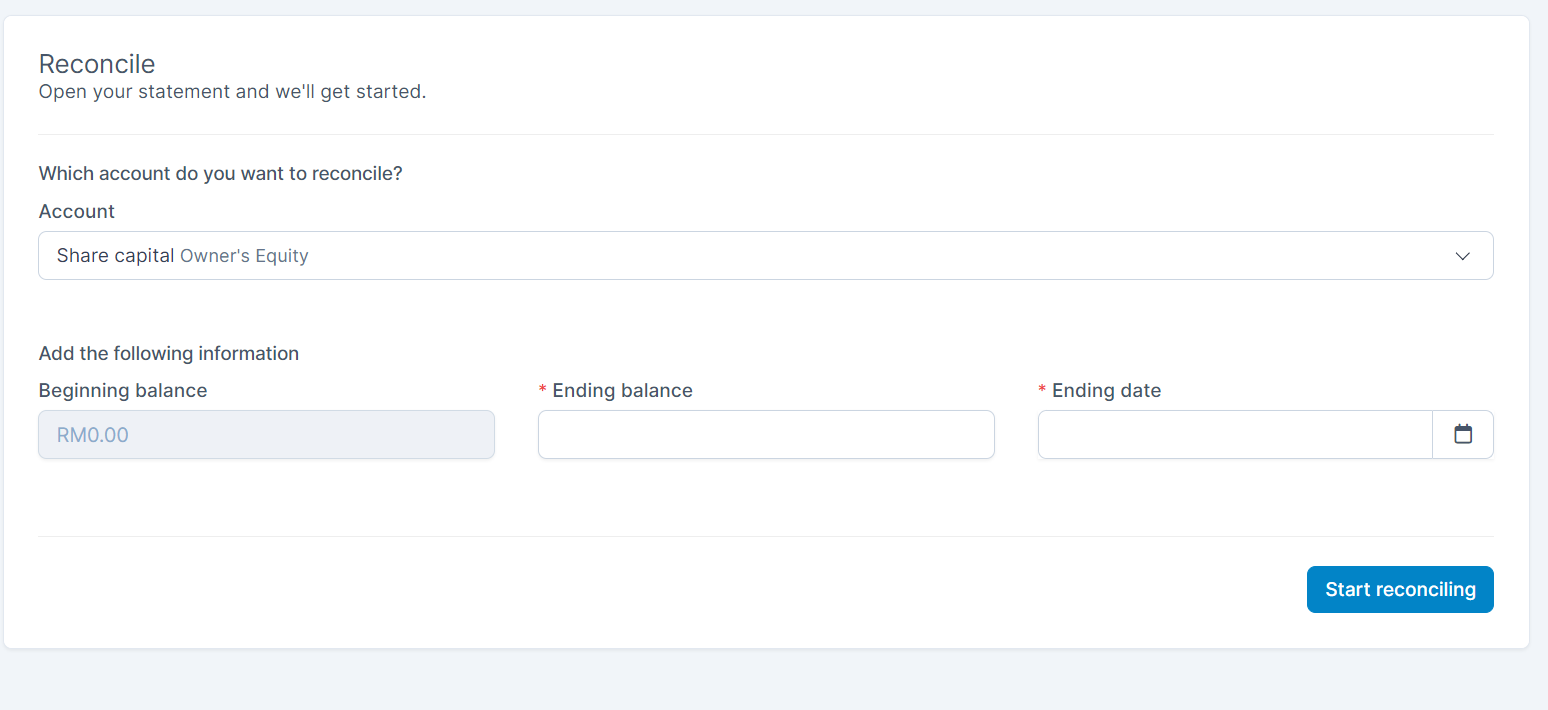

- Reconciliation: Match transactions against bank or credit card statements.

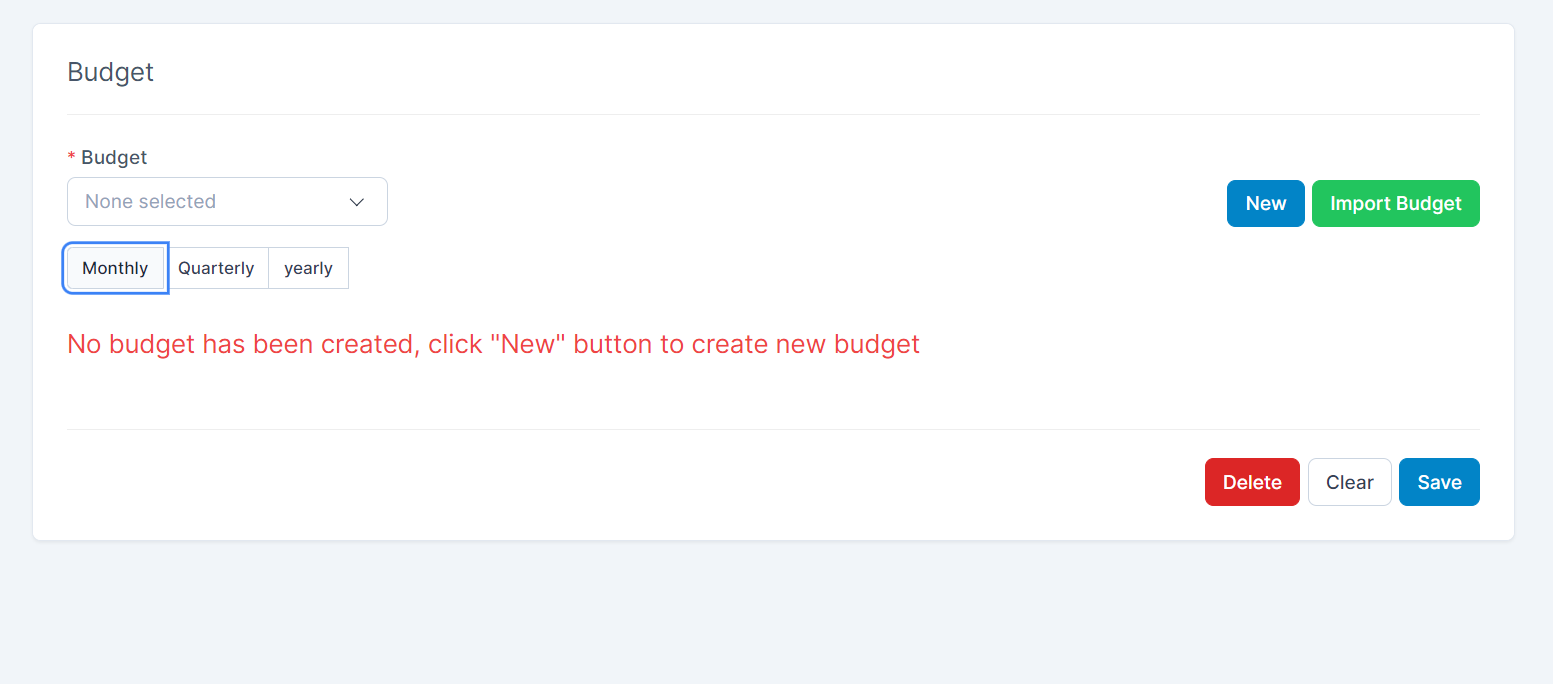

- Budgets Management: Prepare budgets to monitor, track, and compare expected income and expenses with actual amounts.

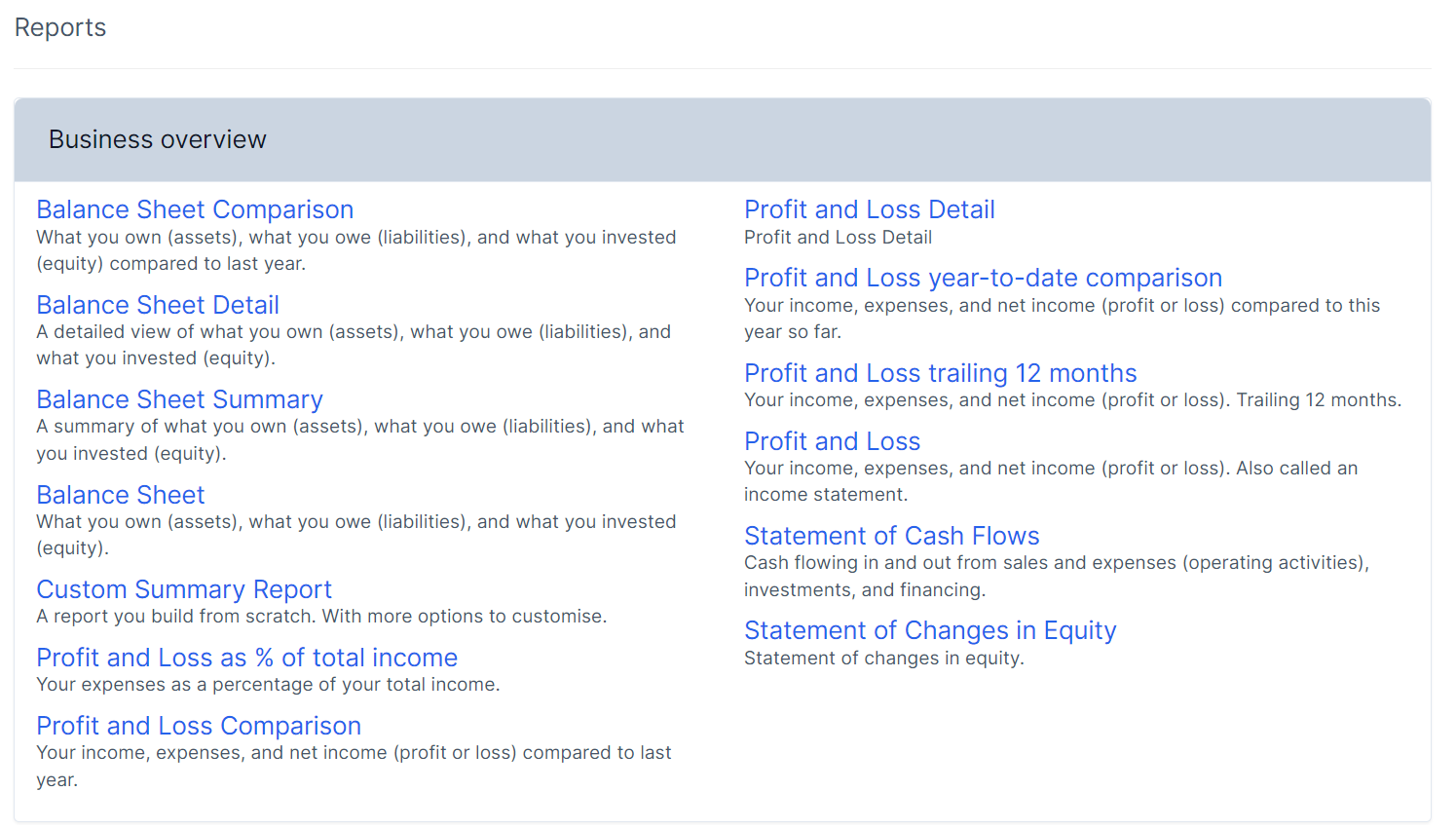

- Business Overview Reports:

- Balance Sheet Comparison, Detail, and Summary

- Profit and Loss Comparison, Detail, and Year-to-Date Comparison

- Custom Summary Report

- Profit and Loss as % of total income

- Statement of Cash Flows

- Statement of Changes in Equity

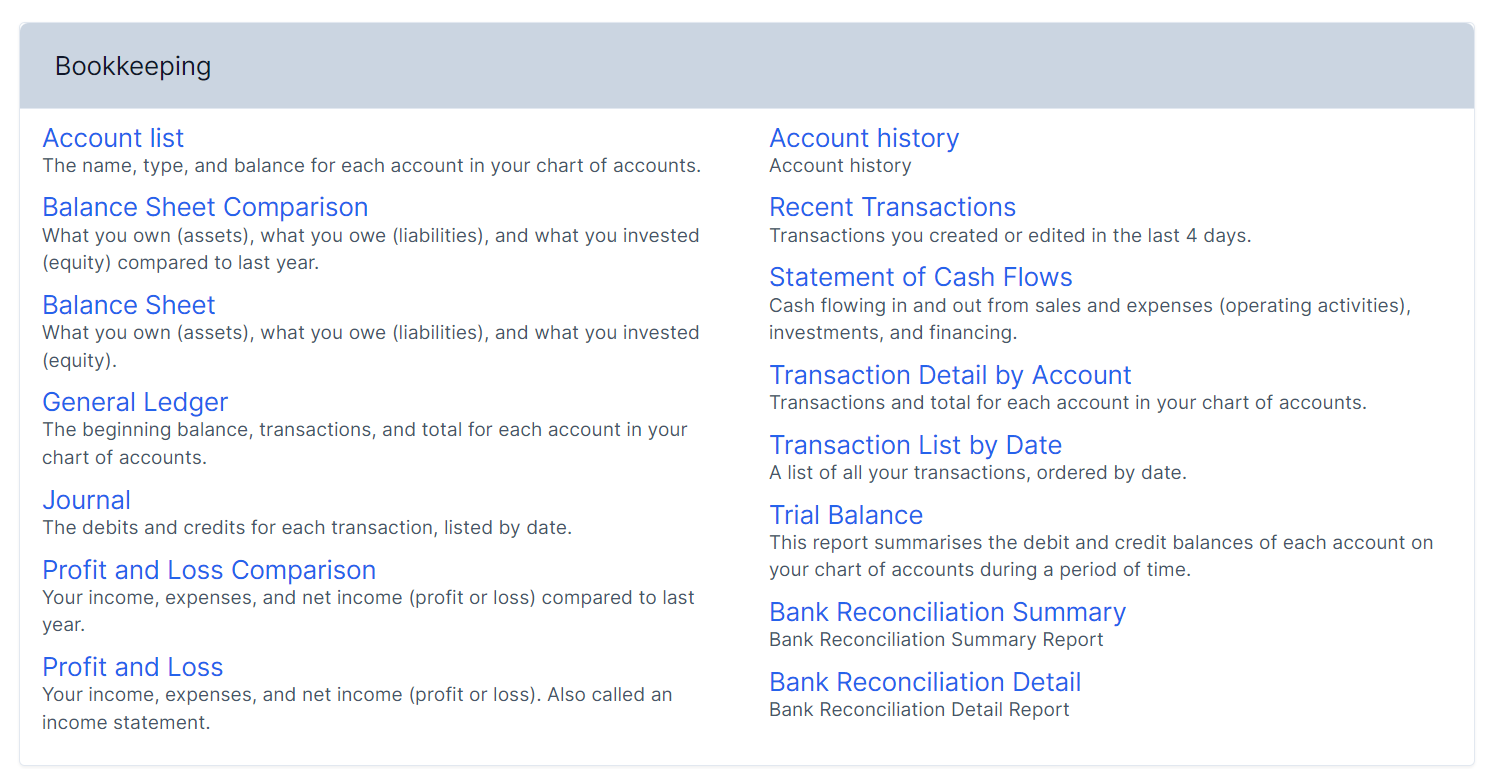

- Bookkeeping Reports:

- Account List

- General Ledger

- Journal

- Recent Transactions

- Transaction Detail by Account

- Transaction List by Date

- Trial Balance

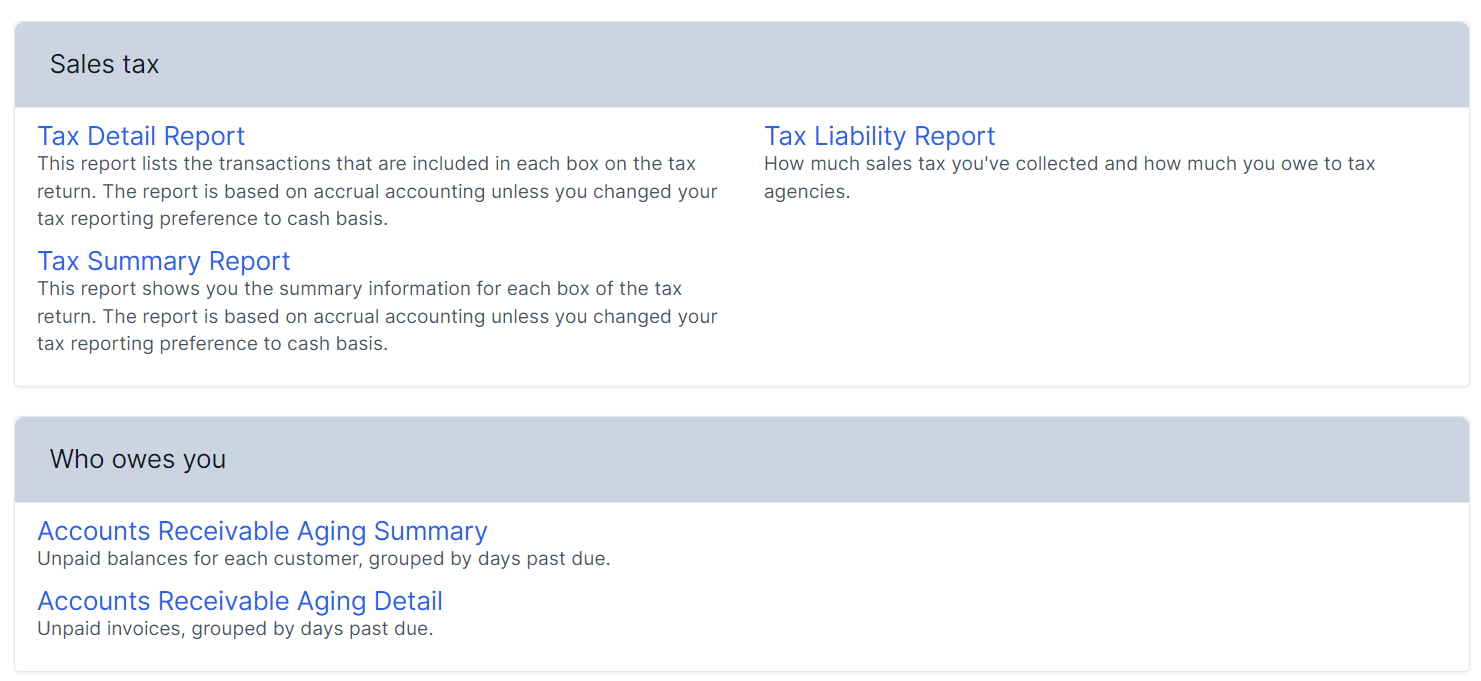

- Sales Tax Reports:

- Tax Detail Report

- Tax Liability Report

- Tax Summary Report

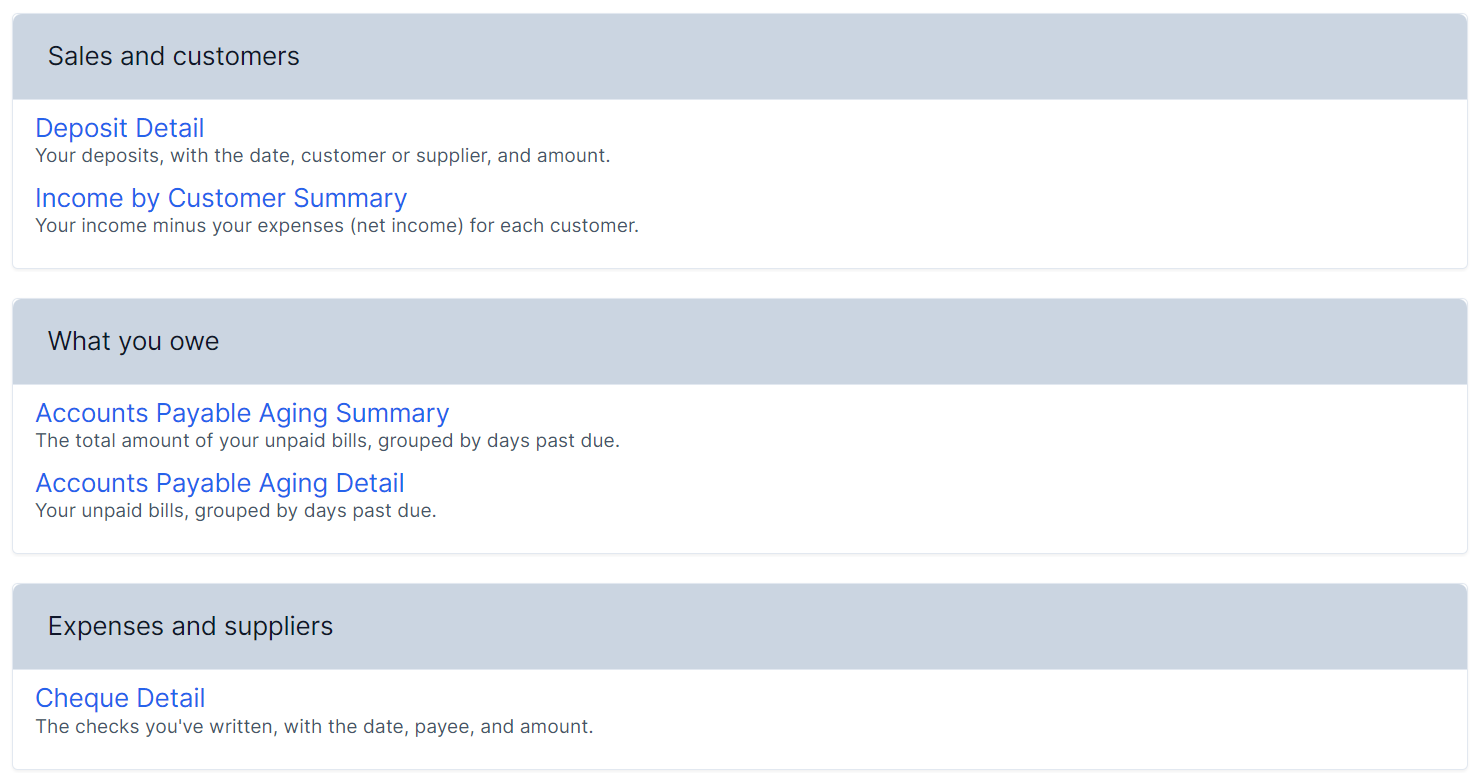

- Sales and Customers Reports:

- Deposit Detail

- Income by Customer Summary

- Expenses and Suppliers Reports:

- Cheque Detail

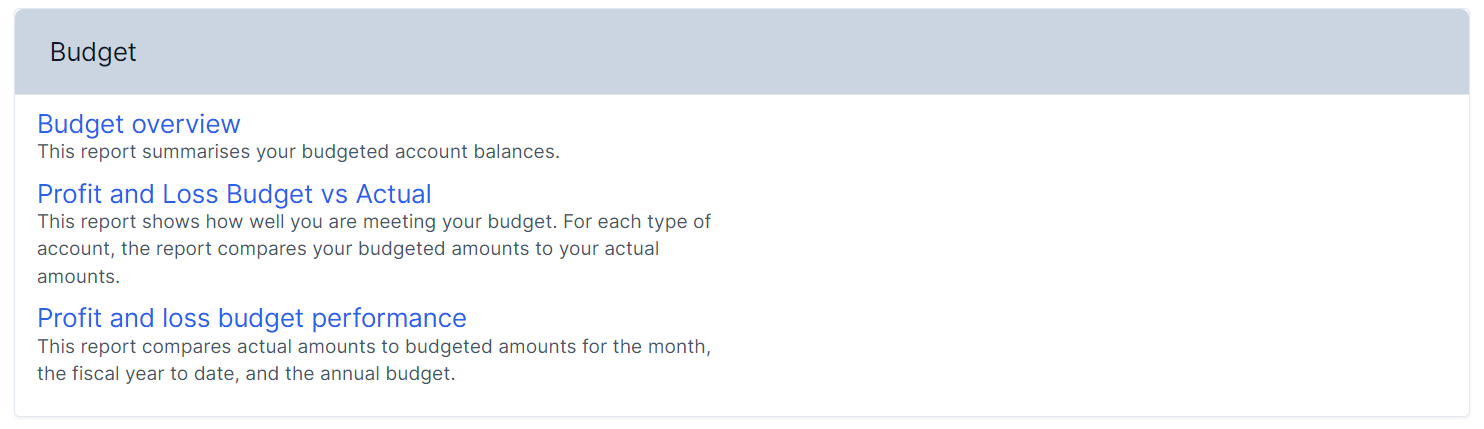

- Budgets Reports:

- Budget Overview

- Profit and Loss Budget vs Actual

- Profit and Loss Budget Performance

- Accounts Aging Reports:

- Accounts Receivable Aging Summary

- Accounts Receivable Aging Detail

- Accounts Payable Aging Summary

- Accounts Payable Aging Detail

- Banking Reports:

- Bank Reconciliation Summary

- Bank Reconciliation Detail

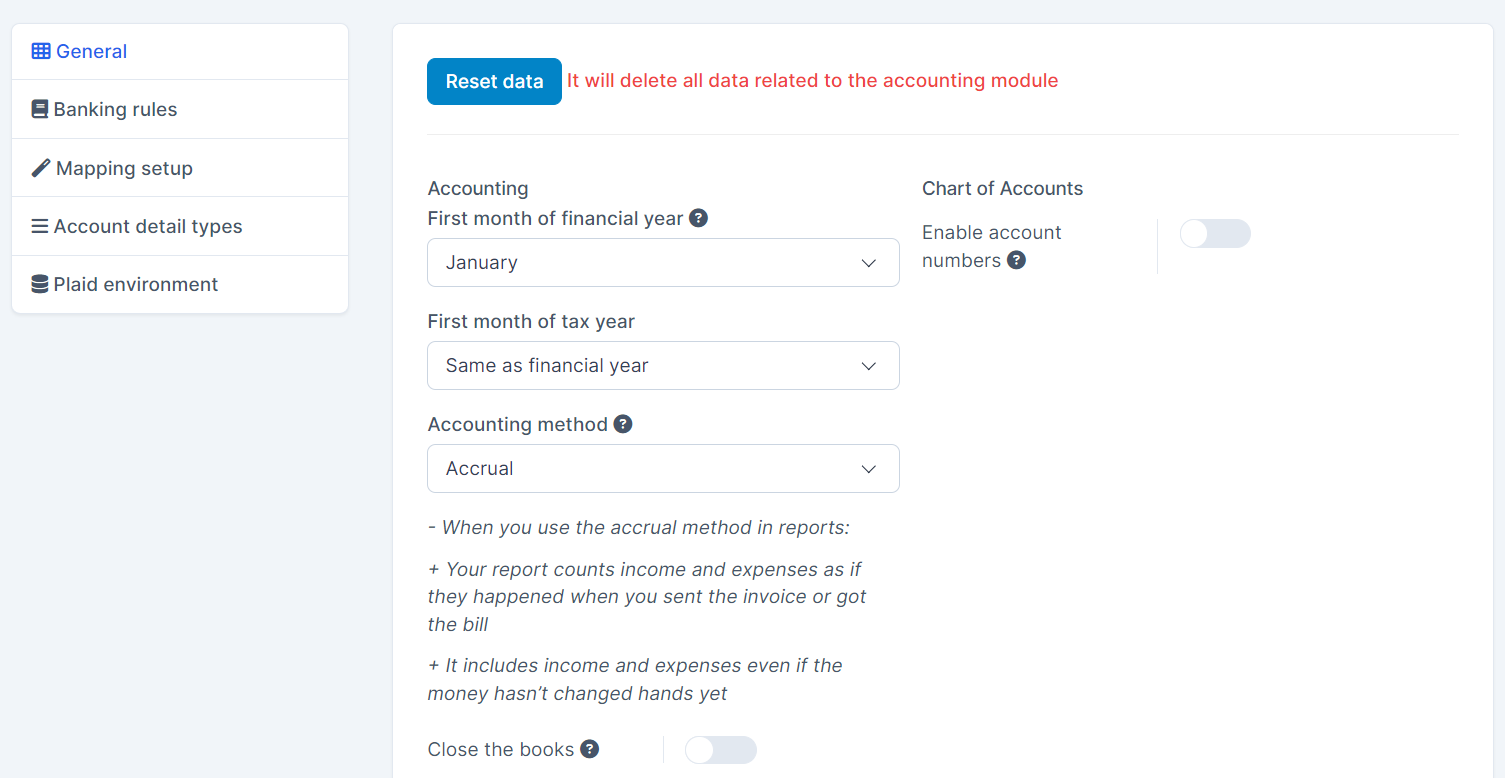

- Settings:

- General Settings

- Account Detail Types Management